Globally, the demand for high-quality stone is growing increasingly. Understanding international trade classifications and export regulations has become more important as the global granite market expands. Granite importers often face challenges with customs clearance, tariffs and documentation, which all depend on one crucial element, the HS Code. In this blog, we will provide you with everything you need to know about HS Codes and Granite Export Rules that importers should know. Stay tuned to learn more details.

Table of Contents

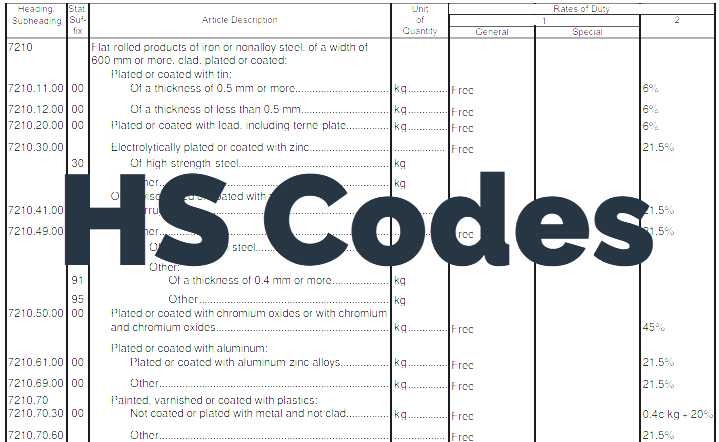

ToggleWhat Are HS Codes?

HS codes are a uniform numerical classification system of six digits used across the globe as a means of identifying and describing products that are traded. HS codes are used to determine important customs information including duties, taxes and other customs-related formalities related to importing and exporting goods. HS codes have a hierarchy where a 2-digit piece defines a Chapter, a 2-digit piece will define a Heading, and a final 2-digit piece will define a Subheading to provide specific description.

Purpose: Streamline customs formality procedures, determine duties or taxes, and to determine restrictions (if any exist).

Structure: A six-digit classification that becomes increasingly specific. For example, the classification 620520 could be broken down as follows: 6 = 62 (Chapter – Apparel not knitted), 05 (Heading – Shirts, not knitted, for men or boys), 20 (Subheading – Of Cotton).

Administration: The HS Code set is maintained by the World Customs Organization (WCO) and is updated every five years.

HS Codes for Granite: A Global Overview

| HS Code | Description | Global Usage / Notes |

|---|---|---|

| 2516 | Monumental or building stone (including granite) | General category for natural stones, including granite in raw form. |

| 6802 | Worked monumental or building stone and articles thereof. | Main heading for processed granite and other natural stone products. |

| 6802.93 | Granite, worked but not mounted or otherwise combined with other materials. | Standard 6-digit code used globally for granite. |

| 68029300 | Granite, including slabs and blocks | Common 8-digit code used in several countries such as India. |

| 6802.23.00.00 | Granite products, cut or polished | Often used in regions like the United States for tariff applications. |

| 6802939000 | Other granite products like tiles or dimension stones | Example of a 10-digit HS Code applied in global markets. |

| 6802.93.00.20 | Granite cut to size, thickness ≤ 1.5 cm. | Used for thin slabs or tiles in specific markets. |

| 6802.93.00.25 | Granite cut to size, thickness > 1.5 cm but ≤ 7.5 cm. | Used for medium-thickness granite slabs. |

| 6802.93.00.35 | Granite monuments, bases, or markers, thickness > 7.5 cm. | Used for thicker granite pieces or monuments. |

Why HS Codes Matter for Importers

HS codes are important for importers because they are crucial for:

- Tax and duty calculation: Customs authorities rely on HS codes to decide what duties and taxes are owed on imported products.

- Facilitating Customs Clearance: Think of HS codes as a facilitator to speed up the clearance of goods by customs officials to avoid delays, inspections, or rejection.

- Enforcement of Regulation: This thinking is especially true for products that may have special rules, licenses, or quotas imposed upon their importation and the HS code ensures your shipment handled those regulations correctly.

- Avoidance of Unintended Consequences: Misclassifying products can result in unintended consequences requiring loss of time due to penalties or fines, or simply overpayment of tax.

- Trade Data: Governments use HS Codes to collect and analyze trade data, and trade statistics inform their trade policy and economic planning.

Understanding Granite Export Rules and Regulations

Important Regulations:

- Import-Export Code (IEC): A critical identification number for all export and import activities.

- Harmonized System (HS) Code: Properly classify the granite products you are selling in question based on product description or HS code (e.g., for a polished slab, use HS code 6802 or for a rougher slab use code 2516).

- Destination country regulations: Research the import and export rules, regulations, or standards for the destination country before sell your product.

- Certifications: Ensure any product certifications (e.g., test report on granite quality) are completed.

Key Documents:

- Commercial Invoice: A full invoice detailing product specifications including price, export terms, etc.

- Packing List: Describes quantity, weight, and description of contents of each container to assist customs clearance inspection.

- Bill of Lading: Contract between shipper and carrier for the goods being shipped. Certificates of Origin: Documenting the country of origin for the imported goods.

How Working with Trusted Suppliers Simplifies the Process

Working with a trusted supplier can simplify the process:

- Ensures correct HS Code classification and documentation

- Guarantees compliance with global export regulations

- Maintains consistent product quality and packaging

- Prevents customs delays and costly errors

- Provides reliable logistics and timely delivery

Conclusion

To sum up everything that has been stated so far, the above information on the topic “What Importers Should Know About HS Codes and Granite Export Rules” states why understanding HS codes and granite export regulations is crucial for importers. In this guide, we have explained everything you need to know about HS Codes and how working with a trusted supplier such as Nakul International can simplify the process.

FAQs About HS Codes and Granite Export Rules

Question 1. What are the common challenges in granite export and import?

Answer. Some common challenges in granite export and import include incorrect HS code classification, non-compliance with destination country regulations, quality disputes and inconsistent labeling and logistics and shipping restrictions.

Question 2. What are the common tips for importers to stay compliant?

Answer. Common tips for importers to stay compliant include:

- Verify HS codes with customs brokers or trade consultants

- Regularly review updates from the World Customs Organization (WCO

- Maintain accurate and transparent documentation

- Partner with certified and experienced granite exporters

Question 3. How to find the correct HS code for the granite product?

Answer. When finding the correct HS code for the granite product, you should look up the code using the product’s specific details (like shape, size, and finishing) in a country’s official HS code search engine or consult with a supplier or freight forwarder.